New Jersey Enacts Personal and Corporate Tax Rate Increases Retroactive to January 1, 2020 - Marks Paneth

China quiet on global minimum corporate tax rate backed by G20 as questions over Hong Kong's tax-haven status arise

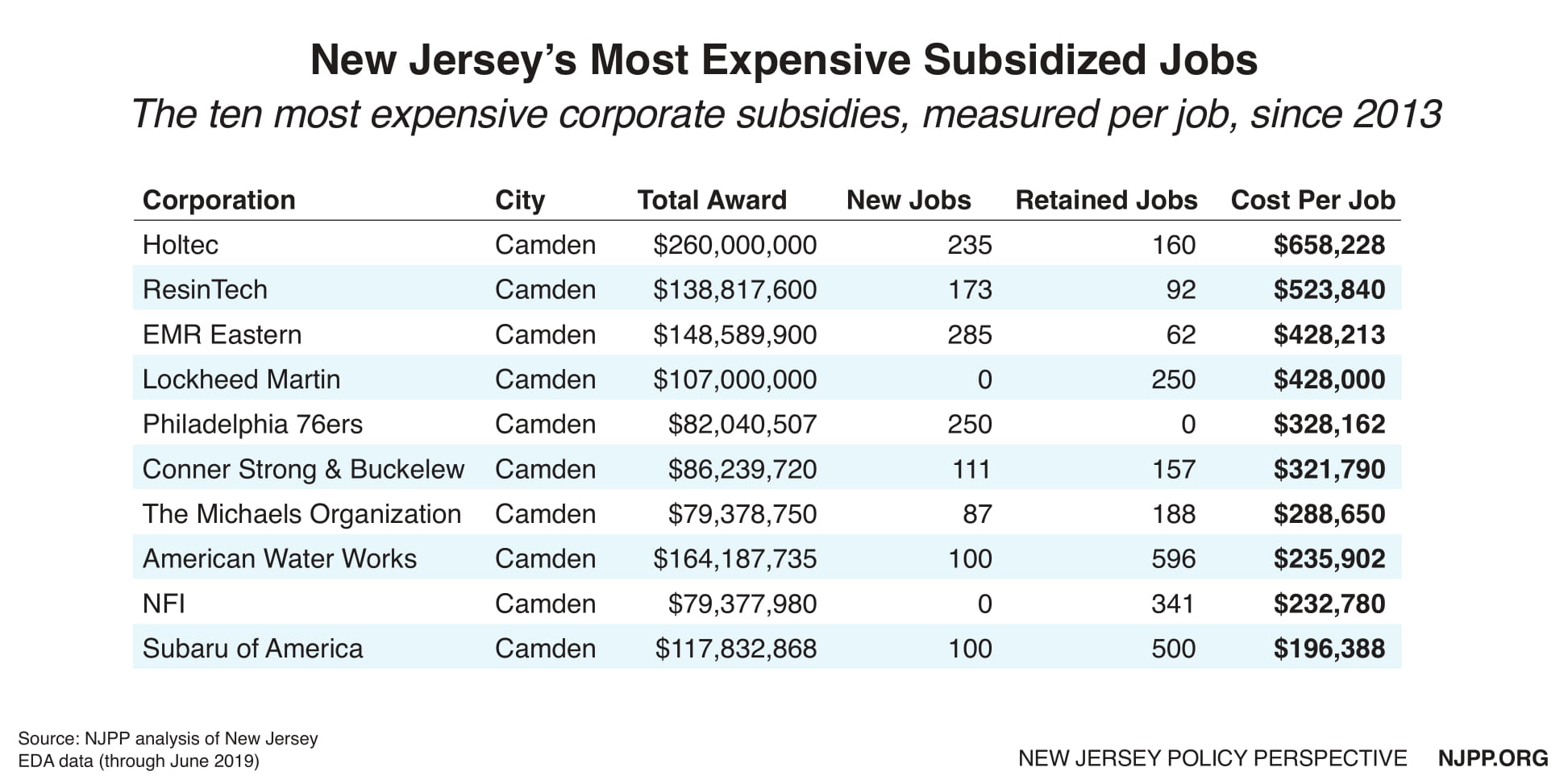

Reining in Corporate Tax Subsidies: A Better Economic Development Playbook for New Jersey - New Jersey Policy Perspective

China quiet on global minimum corporate tax rate backed by G20 as questions over Hong Kong's tax-haven status arise | South China Morning Post

Transparency International - Tax Justice Network released their Corporate Tax Haven Index, that ranks countries by their complicity in global corporate tax havenry. The Top 10 jurisdictions alone are responsible for 52%

EATGN's tweet - "Have you read @TaxJusticeNet's Tax Haven Index 2021? Which countries are the biggest enablers of corporate tax abuse? How is your country rated? Click👉 " - Trendsmap

:max_bytes(150000):strip_icc()/dotdash_Final_Countries_with_the_Highest_and_Lowest_Corporate_Tax_Rates_Nov_2020-02-2d1d9e3a2450426893a7cb627c44baf9.jpg)